Gold Rush? Hotel Rush?

The Age of Hotel Rush

The Age of Hotel Rush: A Hotel Boom Phenomenon and Its Cause

The gold rush which originated from California in 1848 served as a critical foothold in the history of the United States development. The Californian gold rush was a phenomenon in which hundreds of thousands of people gathered in California where a huge amount of gold was discovered. People rushed in from all around the world to make a big fortune at one stroke. Particularly in 1849, about a hundred thousand people relocated to California not only within the States, but also from Europe, Central and South Americas, Hawaii, and even China. Due to this rapid increase of population, California became approved as an official state next year in 1850. What made this rapid increase of population? There were inevitable socio-economic factors at the time. Whereas all the gold discovered in the past fell to the king or the ruling class, the Californian gold rush was a different phenomenon: also ordinary people were able to possess the gold anywhere regardless of its amount if they discovered it. Besides, the US government at the time had to develop the western region rapidly under the governmental control. In this way, the government and the gold-seekers were matched in their needs. This can be seen as why the age of the so-called “rush” arrived. Recently, we are experiencing the age of “hotel rush” which comes close to the gold rush. Traditionally, hotel business was not evaluated as a highly lucrative enterprise because of low demands, excessive initial investment, and institutional obstacles to the promotion of development. Recently, however, the demand of business hotels has explosively increased, and many such projects are in progress indeed. What change of situation made this phenomenon in recent days? Behind the explosive demand growth is surely a necessary background. Clear understanding of this background is expected to help entrepreneurs, investors, designers, or contractors to plan a new enterprise.

Explosive Growth of Tourists: An Undersupply of Business Hotels

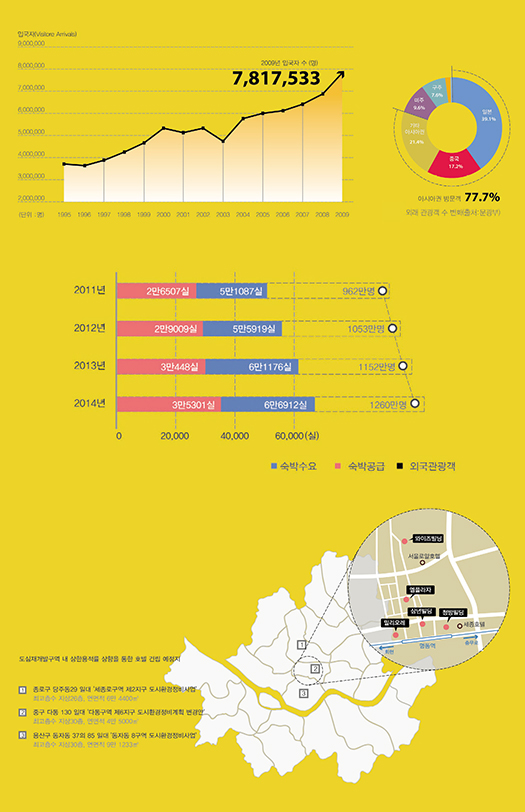

Take a look at the changing number of foreign tourists. As shown in the figure, the number of foreign visitors was about 7.8 million people in 2009 but it sharply increased to about 8.8 million people in 2010, although the accurate statistics were not yet announced. It is expected to grow towards 10 million people by 2011. According to the Annual Statistical Report on Tourism published by the Korea Tourism Organization, most foreign tourists as of 2009 are Japanese (about 3 million people, as 39.1%) and Chinese (1.35 million people, as 17.2%), while the whole Asian visitors account for 77.7% of all visitors to Korea.

However, the number of affordable business hotels that accommodate most tourists is absurdly low, and one research suggests that the undersupply of hotel capacities as the lack of about 4,000 rooms will continue in the region of Seoul Metropolitan City and Gyeonggi Province until 2014. The hotel demand is explosively increasing, in spite of the variations of its degree found according to the survey agents. Anyhow, it seems clear that we are still not so well-responsive to this increase. It may be seen as a responsive measure that the number of hotels increased by two to six every year previously, such as 131 in 2008, 137 in 2009, and 139 in 2010, but the graph shown in Fig. 1 suggests that foreign tourists had already kept increasing, albeit steadily, in the older years. In spite of this continuous growth of tourists, why were not there the increase of hotel projects? The reason can be seen in the following paragraphs on the change of market structure.

The Changing Market Situation: The Increase of Hotel Profitability

In fact, hotel projects, particularly business hotel projects in the urban center, were not such an attractive target to invest. There has been steady demands of business hotels in downtown with easy access to public transportations, but they did not assure good profitability because of expensive land prices even though the room occupancy rate was maintained to a certain extent. However, the atmosphere has changed in these days. First of all, as the supply of offices in downtown increased, the annual profitability fell below 5% with the emerging necessity of finding a business model which will be more profitable, so that business hotels in downtown are becoming the alternative. Also, the oversupply of small- and medium-sized shopping malls in the Dongdaemun area entails a series of low-sales shops. As such, it proves that rental conditions have become aggravated. As it happened, the business of quasi-accommodations such as the so-called “residences” came to be regulated by 2010, so that their demands seem to have transferred into hotel business. Now the room occupancy rates of hotels in downtown Seoul are out of all knowledge. The occupancy rate under 80% in the past skyrocketed for two to three years until 2011, so that it now amounts to 90 to 95% in the downtown business hotels. (According to Annual Statistical Report on Tourism, the occupancy rate in the whole Seoul was 77.3% in 2009.) The change of market situation including the continuous increase of foreign tourists, the steady record of high room occupancy rate, and the shrinkage of other rental market maximized the profitability of hotel business. We can see this change of market situation more clearly by looking into the on-going projects of downtown business hotels. To summarize what cases were published in the media: remodeling an existing building to a hotel, such as Milliore Shopping Center (Myeong-dong, 17 stories); M Plaza (Myeong-dong, 22 stories); Wiseman Building (Myeong-dong, 14 stories), and Hwayang Theatre (Seodaemun, 24 stories). Particularly, Ramada Hotel newly opened “Ramada Hotel Dongdaemun” equipped with 134 rooms by remodeling the previous studio apartment building named “Starclass” along the Euji-ro Road, and is also operating “Ramada Hotel Namdaemun” at the former studio apartment building in Sunhwa-dong, Jung-gu, by converting its usage.

The Change of Governmental Initiatives: Deregulation

In line with this demand of hotels, the central and local governments are also supporting hotel business with deregulation. The core of governmental support measures includes the deregulation of use area, floor area ratio, and health code. Let’s take a look at one by one.

The first measure is the deregulation of use area. So far in residential (general or semi- residential) areas, hotel has not been approved as a use by the Framework Act on the National Land. This act was one of the causes that significantly constricted the business hotel industry. Generally, the average daily rate (ADR) of affordable hotels is determined as a limited range in the market. Also, the quality level of a building, i.e. the construction cost per area, is almost determined because it is difficult for a business hotel which is not first-class to receive the higher ADR than the market price. If so, the determinant factor that directly influences feasibility is the land price.

At non-residential areas, i.e. commercial areas approved as hotel sites, high land prices caused excessive initial investments. Although one could legitimately do hotel business in a commercial area, it was rather constricted by such high land prices. This problem was resolved by amending the Tourism Promotion Act to allow the hotel use in residential areas if certain qualifications are fulfilled. However, this amendment is applied only to tourist hotels, the business plans of which should be approved as per the Tourism Promotion Act, in order to prevent the mushroom growth of general hotel business. After all, the explosive demand in the present market situation is of tourist hotels, so that the business hotels for foreign tourists can fulfill the condition of mitigation enough. In the downtown of Seoul, there are still many residential areas, the land prices of which are relatively cheaper than that of commercial areas so as to have large influence on improving the feasibility of hotels. Indeed, many new project areas are in general or semi- residential areas.

The second measure is the deregulation of floor area ratio. Let’s focus on the case of Seoul. For tourist hotels, the Seoul Metropolitan Government allows the deregulation of floor area ratio up to 20% (which varies with the area ratio of the tourist hotel to the whole building.) As a matter of course, whether to deregulate or not is determined through deliberation, which is held in the process of approving the business plan as per the Tourism Promotion Act. For example, where the floor area ratio is allowed up to 300%, planning a whole building as a tourist hotel in a residential area can benefit from the deregulation of the upper limit to 360%. This is directly related to the profitability of business.

The third measure is the deregulation of health code. Deregulation of hotel control in residential areas as per the Tourism Promotion Act does not resolve all the problems. This is because schools are scattered in most residential areas, so that the project site is most likely to be in an absolute or relative cleanup school zone. In this cleanup zone, you cannot build a hotel as per the Health Act. A contradiction is made here: although the use non-permitted by the Framework Act on National Land was permitted by the Tourism Promotion Act to facilitate hotel business, it is regulated in reality by the Health Act so that the business can hardly proceed. To solve this problem, the legal notification preannounced by the Ministry of Culture stipulates the exclusion of tourist hotels, which fulfill some qualifications, from the non-permitted use even within the clean-up zone. This action actually helps to proceed with hotel projects.

Besides, in earlier days, the collective housing to be approved under a business plan was not legally permitted to be constructed together with hotel in a mixed-use way, but now this clause has been removed for the case of commercial areas. Now it is possible to build such a mixed-use architecture of collective housing and hotel, and this is expected to trigger in Korea the architectural type of luxury housing at the upper part combined with hotel at the lower part.

We have thus far looked into the background of hotel boom. After all, we can summarize it into the increase of feasibility by the explosive growth of foreign tourists, the increasing feasibility of hotel business with the change of market situation, and the deregulation influencing the feasibility promotion. If we understand the recent boom of hotel industry through this background, we should also back up such information as hotel rating, target ADR, local land cost, accessibility, and regulations mitigated or supposed to be mitigated. According to this information, architectural plans appropriate for the initial project cost and situation (architectural forms in accordance with optimum project cost and target needs) should be followed and this will make a shortcut to successful hotel business.

Lifestyle Hotel

The Trend of Hotels and Their Future Development: Evolution into Lifestyle Hotels

Hotels no longer exist as commodities that simply provide room and board. The building as a hotel has indoor and outdoor spaces, each of which is evolving into a great form fit for the needs of main customers. These hotels were previously classified by accommodation fees into luxury, upscale, economy, and budget hotels, or by provided services into full service and limited service hotels. Today, however, they are more diversely and singularly classified into spa, design, family, golf, and romance hotels, making ceaseless attempts to become spaces suitable for the customers’ lifestyles.

Overseas and Domestic Trends of Hotel Development

In earlier days, there was a significant time lag between the overseas and domestic trends of hotel development. In the 1970s when Walt Disney World Resort was already introduced overseas as a concept of destination resort and theme park, Korea witnessed the emergence of hotels invested by private capital. In the 1980s when specialized hotels such as airport, convention, and all-suit hotels were being developed overseas, Korea was seeing extensive construction of hotels around the Asian Games 1986 and the Seoul Olympics 1988. In the 1990s when Las Vegas began growing again since the 1950s and expanding its user class with large-scale themed spaces to target the “family travel” market, Korea saw the beginning of the heyday of comprehensive resorts like Phoenix Park, Sungwoo Resort, and Vivaldi Park as the ski and golf population increased welcoming the 100 million dollars of GDP. That is, this suggests that similar commodities have been introduced overseas and domestically with a significant time lag. In the 2000s, the diversification of hotels began in earnest overseas and the hotel commodities existing now in Korea firstly appeared. In this period, the baby boomers overseas who were much interested in health began to lead the “Spa” boom and so various health-themed resorts emerged. At the same time, the role of food and beverage (F&B) gradually increased: particularly in Las Vegas, the F&B of hotel/resort was improved one level higher with famous chefs scouted to deploy active marketing. Developers like Ian Schrager and hotel chains like Starwoods began to touch off the “Boutique Hotel” boom by responding swiftly, giving birth to a new hotel culture. That is, they made much efforts to provide a differentiated experience with a little more luxury and higher-quality service although in a small scale. Besides, there emerged “collaboration” that was mainly seen in the fashion industry, and hence a new form of hotels combined with fashion companies. A case in point is Armani Hotel and Resort. In other words, fashion companies are becoming “hospitality brands” that create lifestyles covering the whole life by extending their scope beyond simple fashion towards dining and living. Korea is also witnessing the appearance of hotels conceptualized in differentiated manners such as W Hotel and Park Hyatt, as well as the emergence of golf resorts and personal villas that reflect the increasing demand of luxury facilities due to the polarization of wealth and the growth of the rich since the IMF crisis.

By the 2000s, the trend lag between overseas and domestic hotel developments decreased significantly. Beyond the main elements of the 2000s such as uniqueness, diversification, and differentiation, social values emerged as important elements. There was an upsurge of interest in such key words as ethics and environment. Therefore, landscape elements themselves became more valued than artificial facilities, with small-scale, low-density, and environment-friendly hotels gradually becoming more preferred to large-scale resorts. These new elements emerged importantly not only for hotel development but also for operation. For example, the “Aman Resort” brand shows a successful case of integrating traditional environmental elements as a cultural component in a resort. Efforts to maintain social values are also found in Korea, such as Sheraton Hotel Incheon that achieved the LEED-NC (New Construction) certification. Seen from a commercial perspective, Korea in 2011 was witnessing the boom of mixed-use hotels which were all the rage in Shanghai and Bangkok since the 2000s. The main trend of this period is mixed-use development that can create synergy with shopping and entertainment, such as the Courtyard Marriott of Times Square, the Sheraton of D-Cube City, and the Conrad of IFC. Also, the high land prices in Seoul and urban centers encourage the main trend of developing business hotels that can maximize profitability, which is seen as the result of local characteristics.

The Change of Lifestyle

In The Consumer Lifestyle Report 2011, LG Economic Research Institute identifies “Body,” “Meaning,” “Individualism,” “Realism,” “Home,” “e-Socializing,” and “Mobility” as the main lifestyles. That is to say, Korean consumers tend to value health, pursue social values, want individuality and reasonable consumption, highly regard family, enjoy communication with social media, and intend to lead a life transcending space and time. As if to reflect this tendency, the present hotel & resort market is characterized by differentiated themes and concepts such as “healing”-themed Resom Forest Resort, “history”-themed Lotte Resort Buyeo, and “Boutique”-themed Hotel La Casa, or foregrounds an world-renowned architect’s resort design as a differentiated work as in Phoenix Island. In short, we can clear see that now is the time of individuality and differentiation beyond simple leisure facilities, influenced by the increase of income and the extended vacation. However, this is only the physical articulation of direction through architecture or interior design. To go one step further here, hotels will make ceaseless efforts to create the culture of the time more actively to satisfy customers. Besides, such efforts will also be followed as to make one space serve multiple functions, providing various experiences beyond existing ones. These efforts will provide customers with valuable experiences in a higher dimension, which will continue to evolve as the products fit for the various lifestyles desired by customers.

Reconstructed Excerpts from Gihong Park and Myeongdeok Choi, “GOLD RUSH? HOTEL RUSH?”, Junglim Architecture Works 2012